The federal payroll tax tables that set the parameters for withholding non-voluntary taxes from employees' paychecks may change periodically. They generally are updated annually with new Circular E government publication in the month of December. These new numbers are also available on the government web site (www.irs.gov).

In addition to federal withholding, there may be state taxes and/or local taxes that must be withheld. In all cases, the responsibility of being aware of tax rate changes and maintaining the tax tables is shouldered by each company. SSI can help interpret the state tax needs but will not send alerts for any tax rate changes.

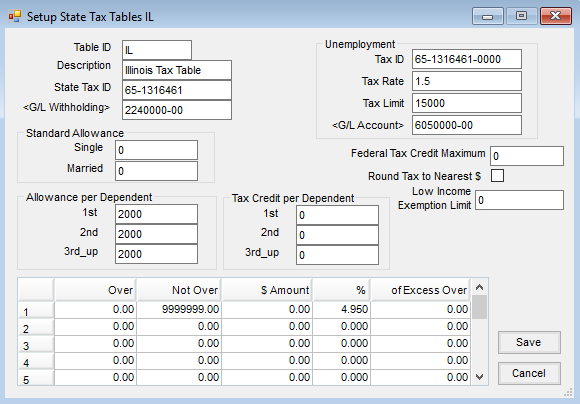

- State Tax ID – When multiple tax numbers are required to be used in one Agvance dataset, this area allows the State and Tax ID to be specified based on the Dept. Code specified on the employee’s Profile tab found when adding or editing an employee at File / Open / Employees. Additional setup is required. Contact SSI Support for assistance if multiple FEINs are within one Agvance dataset.

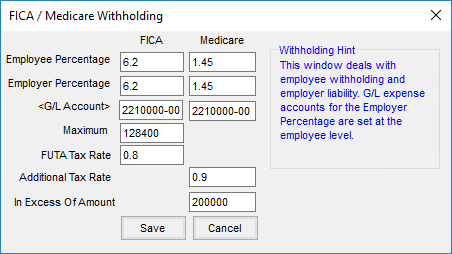

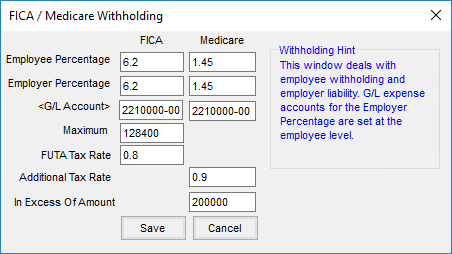

- FICA/Medicare – The employer withholds a set percentage of the wages from an employee each paycheck. As the Withholding Hint on the screen indicates, the employer's matching contribution is posted to an expense account defined at the Employee level. To set the employee contribution account, go to File / Open / Employee on the G/L tab.

Note: Some insurance plans and annuities may be exempt from some of these taxes. Check with your accountant to see which, if any, deductions should be exempt from taxes. If a deduction is exempt, mark it as such at Setup / Preferences on the Payroll tab.

- Employee Percentage – The percentage of withholding for both FICA and Medicare is printed in the government Circular E publication. Enter the percentages without the percent symbol. For example, 6.2% is entered 6.2.

- Employer Percentage – The percentage for the employer portion of FICA and Medicare. Enter the percentages without the percent symbol. For example, 6.2% is entered as 6.2.

- G/L Account – Enter the default liability accounts for the amounts withheld from the employee for these taxes. This account can be overridden at File / Open / Employee on the G/L tab if necessary.

- Maximum – Enter the wage cap that has FICA withheld. The program stops withholding FICA tax when the year-to-date FICA wage exceeds this figure. The maximum is found in the Circular E publication.

- FUTA Tax Rate – Enter the Federal Unemployment Insurance rate. This is used for calculating the Unemployment Insurance report when using the Federal option.

- Additional Tax Rate – For the additional Medicare tax for the highly compensated, the rate is entered here.

- In Excess of Amount – Enter the annual wage amount where the additional Medicare tax should begin withholding.

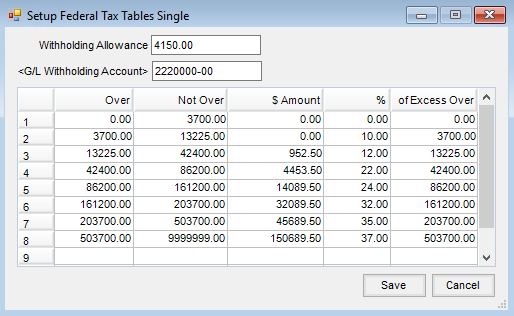

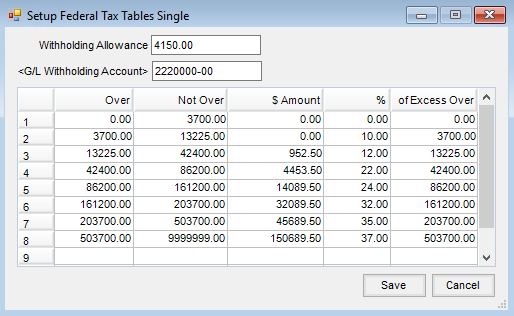

- Federal Tables – All this information is found in the annual Circular E publication issued by the government. It can be downloaded from the SSI web service. Please call SSI if this information cannot be located. There is a table for Single and a table for Married that must be filled out prior to processing payroll.

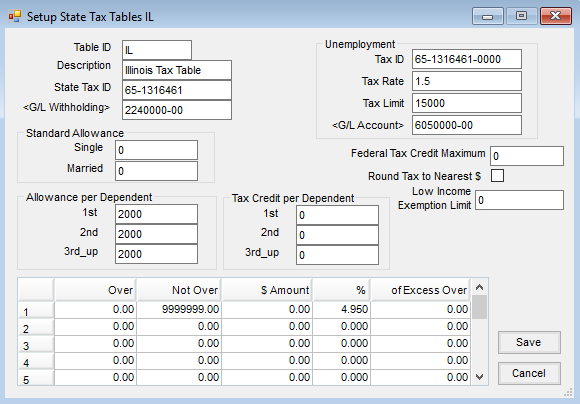

- State Tables State – Tax parameters must be defined even if there is no state income tax. These vary from state to state and the tables must be manually entered. For clarification interpreting state taxes as it relates to the input screen, call SSI for help.

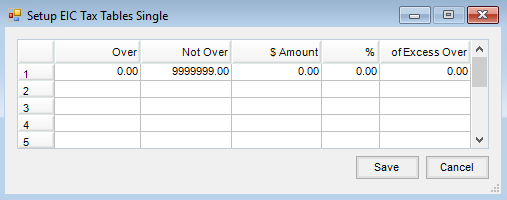

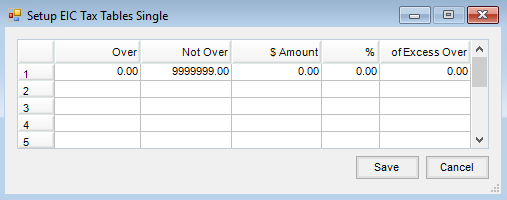

- EIC Tables – Earned Income Credit cannot currently be claimed on the employee’s paycheck. The tables should be set to all zeroes as follows. If the Federal tax tables are downloaded from the SSI web service, the Earned Income Credit tables are included in that download.

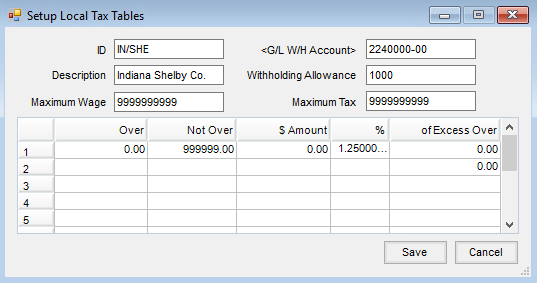

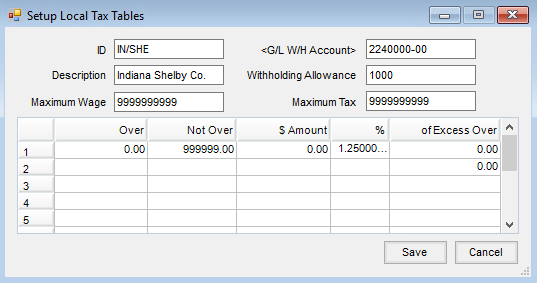

- Local Tables – Local taxes such as county or city taxes being withheld from the employee paychecks are defined here.